Welcome to Hey Pops Financial!

Welcome to Practical Financial Wisdom for Everyday Life

Welcome to Hey Pops Financial, where Larry, “Pops,” and Mitch share down-to-earth advice on money, careers, and life, unlocking financial freedom for those looking to live a fulfilling life. Our mission is to help you unlock financial freedom through simple, relatable tips that anyone can follow. Whether you’re just starting out or looking to refine your financial habits, you’ll find practical guidance here—from budgeting and investing to building wealth and making informed life decisions. Join us as we navigate the journey to financial security together with a touch of humor and a lot of common sense.

Meet Pops

Larry ‘Pops’ Bates, 66, has been married to his wife, Shannon, for 43 years and is the father of seven children, including two adopted from Russia 28 years ago. As a grandfather to 27, Larry places family at the center of his life. He holds a bachelor’s degree in Pre-Physical Therapy from BYU and a Master’s degree from the US Army-Baylor University Program in Physical Therapy. With over 20 years of experience running a private physical therapy practice, Larry currently serves on the board of directors for Hedgehog Investments. A US Army veteran, Larry enjoys real estate, restoring old homes, reading, and spending time outdoors. His top priorities are his family, faith, country, and college football—hopefully in that order!

Meet Mitch

Mitch Bates has been happily married for 12 years and is a proud father of six. He loves spending time outdoors with his family and has a passion for all things fantasy and personal development. A Navy veteran, Mitch lives by the philosophy: “You need to put value in your brain before you put value in your bank.” He believes that making money is great, but knowing how to use it is even more important. Deeply committed to his faith, country, and family, Mitch enjoys every opportunity to learn and grow.

The Six Pillars to Unlocking Financial Freedom

The Six Pillars to unlocking Financial Freedom are the foundation for achieving lasting financial security and independence. Each pillar offers practical strategies and insights to guide you on your journey to financial freedom. From mastering personal finance and making smart career decisions to building wealth through investing and entrepreneurship, these pillars cover all aspects of financial well-being. By understanding and applying these principles, you can make informed decisions, manage your money wisely, and create a secure future for yourself and your family.

Explore Our Financial Freedom Resources

Financial Wisdom Apparel and Gear

1

Credit Building Tools and Resources

2

3

Budgeting and Money Management Tools

Entrepreneurship and Side Hustle Resources

4

Explore Our Channel for Practical Financial Insights

Don’t miss out on the latest tips and advice! Subscribe to our channel for regular updates and start your journey to financial freedom today.

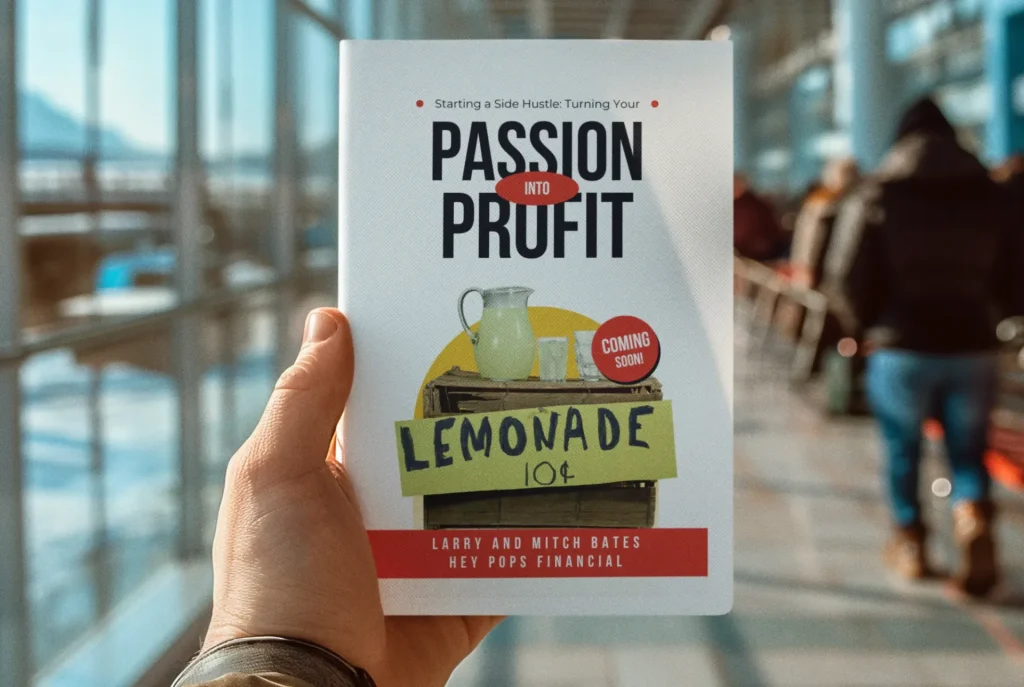

Courses and Ebooks Coming Soon to Empower Your Financial Journey

Get ready to dive deeper into financial freedom with our upcoming courses and ebooks. Stay tuned for practical guides and in-depth resources designed to help you master your money and build a secure future.

Mastering Personal Finance: A Guide to Budgeting and Saving

- The Fundamentals of Budgeting

- Setting and Achieving Financial Goals

- Building and Maintaining an Emergency Fund

Ebook: Investing 101: A Beginner's Guide to Building Wealth

- Introduction to Investment Basics

- Getting Started with Small Investments

- Diversifying Your Portfolio

Ebook: Starting a Side Hustle: Turning Your Passion into Profit

- Identifying Profitable Side Hustle Ideas

- Creating a Business Plan for Your Side Hustle

- Marketing and Growing Your Side Hustle

Here are common concerns and queries about personal finance, investing, and more. Whether you’re just starting your financial journey or looking to refine your strategies, you’ll find clear, practical answers to help guide you. If you have a question that’s not covered, feel free to reach out—we’re here to help you achieve financial freedom with straightforward advice and support.

How can I start budgeting effectively with limited income?

Start by tracking all your income and expenses to understand where your money is going. Prioritize essential expenses like housing, utilities, and food, and allocate a portion of your income to savings, even if it’s a small amount. Use budgeting apps like Mint or YNAB to help you stay organized and adjust your budget as needed. Remember, the key is consistency—stick to your budget and make gradual improvements over time.

What are the first steps to begin investing as a beginner?

Begin by educating yourself on the basics of investing, such as understanding stocks, bonds, and mutual funds. Start small with micro-investing platforms like Acorns or Robinhood, which allow you to invest with minimal capital. Focus on building a diversified portfolio to spread your risk, and consider setting up automatic contributions to stay consistent. It’s also wise to invest in low-cost index funds or ETFs as a beginner, and always invest for the long term.

How can I balance a side hustle with my full-time job?

To balance a side hustle with your full-time job, start by setting clear goals and boundaries. Dedicate specific hours outside of your regular work schedule to your side hustle, and use time management tools to stay organized. It’s important to prioritize tasks and avoid burnout by not overcommitting. Remember, your full-time job is your primary income source, so maintain a healthy balance between both to ensure long-term success in both areas.

What financial tools and resources do you recommend for beginners?

For beginners, we recommend using budgeting apps like Mint or YNAB to manage your finances and track spending. For investing, consider platforms like Robinhood or Acorns, which are beginner-friendly and allow you to start with small amounts. If you’re looking to build credit, secured credit cards can be a good starting point. Additionally, online courses and financial blogs can provide valuable insights and help you deepen your financial knowledge.

Contact Us

We’d love to hear from you! Whether you have questions, need more information, or want personalized tips and insights, feel free to reach out. Contact us today and let’s work together on your journey to financial freedom.